How do I set up taxes in my online store?

It is possible to set up taxes to charge the proper rates during checkout. This makes it easier to apply and collect the correct rate, report income, and comply with local tax laws.

To set up taxes, select the E-Commerce tile.

Select Settings > Taxes. You can add taxes automatically or manually.

Automatic Tax Calculation

For users in the US, Canada, Australia, and Europe, we calculate tax rates automatically based on your store and customer's location. At checkout, the customer will be charged a proper tax rate according to country and regional tax rules.

Tax laws are constantly changing. Country, state, or even city governments may apply new tax rates that a business owner is expected to keep up with. We always stay up to date on tax law.

Setting up Automatic Tax Calculation

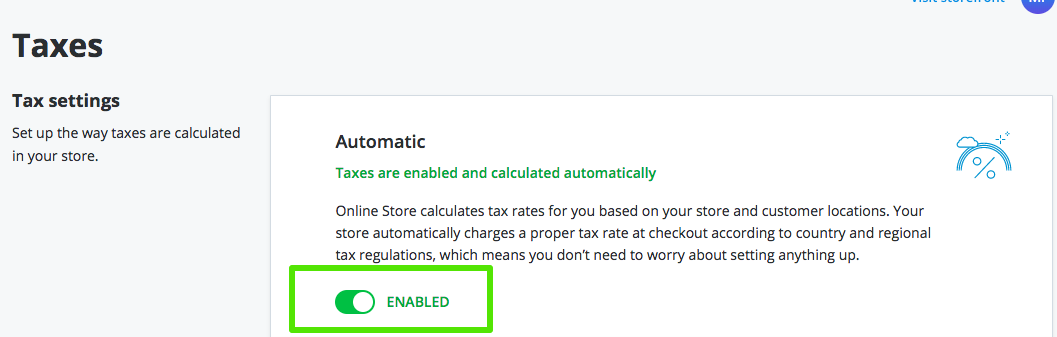

To enable automatic tax calculation, toggle the Automatic button to Enabled.

Once enabled, the automatic tax rate will determine a precise tax rate at checkout depending on where you and your customer are located. The tool knows the tax rules in your country, state, and even county and city, and applies them properly to each order:

- Whether you’re located in a region with origin-based or destination-based tax schema

- Whether shipping cost or discounts are taxable

- Whether you should charge tax in another state or country not

The tax rate is calculated with a zip code accuracy. If your customer provides zip+4, it will be calculated with even higher precision. In some states (and the number of such states is growing), the tax is calculated with a street address level precision.

Are county taxes calculated automatically? What about zip+4 taxes?

Yes, the automatic tax calculator recognizes counties, zip codes, and even street addresses (in some states). If your customer provides zip+4, the rate will be calculated with even higher precision.

What if some of my products are not taxable?

Automatic tax rates apply to all products by default. If you do not charge tax for some of your products, or you need multiple taxes, you will need to use manual tax setup.

Setting up Manual Tax

You can manually configure your store to calculate tax rates for different regions, zones, and countries.

For example, you need to create a 7.5% tax for California.

Select Settings > Destination Zones, and select Add New Zone.

Update the Zone Name and select Add State.

Select the state.

Select Save.

Select Settings > Taxes. Select the Manage Tax Rates button.

Select Add New Tax.

You have the option to edit the Tax Name, set the tax applies to, and zones defines by. Select the Specify Rates Per Zone button.

Select the Rates Per Zone dropdown and select the new destination zone you created.

Add the tax rate and select Save.

The specific tax rate has been added.

Why isn't tax calculated if I use PayPal Express Checkout?

Most likely your "Zone defines by" tax option is set to "Billing address". PayPal does not return a customer's billing state code, only the country code. That is why we can't calculate the tax if it's based on the billing address. Please change the "Zone defines by" option to "Shipping address" to fix the issue.

I am from the EU. How can I set up my store to comply with EU business regulations?

EU countries like Germany and Italy have certain regulations that impose rules on businesses and require specific display of product prices and sales taxes. Our stores fully comply with these regulations.

How do I set up a tax rate for a certain state or city?

The tax calculation algorithm determines which tax to apply by looking through the configured tax rate list, top-down. When it finds a matching zone, it stops and applies the corresponding tax rate. So you can define tax rate for particular state(s) or cities (using zip codes), then add a rate for "USA" at the bottom of the list. In this case, the USA rate will be applied to all states except the states configured explicitly.

Tax Calculation in the US

In the US, merchants must pay taxes to the states where they have any connections to their business.

Related Articles

How do I mark customers as tax exempt in my online store?

Some customers, like wholesalers and nonprofit organizations, can be exempt from taxes. You can mark such buyers as non-taxable so they can check out in your store without having tax applied to their order. To mark customers as tax exempt, select ...How do I make a product in my online store non-taxable?

If there are non-taxable products in your store, you can set up a zero tax for them using the manual tax rates option. To make a product non-taxable, select the E-Commerce tile. Select Catalog and select the product you would like to make ...How are taxes calculated in my online store?

We calculate tax rates based on the store and a customer's location. The store charges a proper tax rate at checkout according to the country and regional tax regulations. We recommend that you allow the system to automatically apply the tax rate.Can I enable "Selling on Facebook" for my online store?

Selling on Facebook allows you can automatically upload and sync your store product catalog to the mobile-friendly Shop section on your Facebook business page. The Facebook Shop can be viewed on a desktop, mobile as well as the Facebook app. All ...How do I enable free shipping in my online store?

Customers may often abandon their shopping carts because of the extra shipping costs. By offering free shipping options at checkout, you can encourage your customers to complete their orders. There are a few different ways that you can set up free ...